Contents:

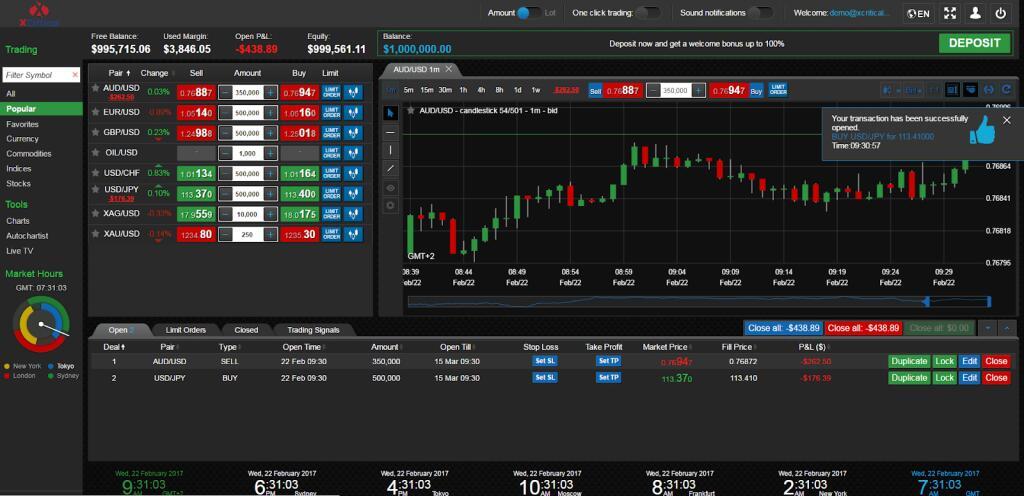

Crypto trading with LimeFX is fairly new, as they only added to their offerings in September 2019. The digital currencies were added to their fast growing platform thanks to a strong demand from over 800,000 of their account holders. This backs up our high customer service ratings earlier in this LimeFX review as it shows they do listen to their clients. As per the LimeFX website, all deposit types should take 1-2 business days to clear, except bank transfers which can take a little longer. When testing the payment options for our LimeFX review, we found this to stand fairly true. If you don’t want to have to wait for each one off deposit, you can set up a recurring deposit.

Robinhood has several investment options, which investors with taxable brokerage accounts can try out. LimeFX also gives free access to financial advisors, meaning investors can receive ongoing guidance and support whenever it’s required. Robinhood is a popular, no-fee online trading platform that also offers cryptocurrencies. Schwab is another top broker, offering Intelligent Portfolios for automated investing.

As you can see, LimeFX and Robinhood appear to be similar companies for online investors, but those similarities end quickly. Both companies are geared toward millennial investors, but depending on your financial situation and level of confidence with investing, one option is likely better for you than the other. Robinhood runs a bare-bones operation in order to keep their costs down, and in this particular arena, it shows — you won’t get any access to financial advisors through the program. For those who are entirely new to investing and prefer a bit more interaction with a pro, Robinhood falls short. If you’re a SoFi member, then you have access to these financial advisors as much as you need, whether you’re just starting out with financial goal planning or you need advice on a trade you’re thinking about making.

Stock trading most certainly costs money, as shown by the ongoing skirmish over fees between exchanges, their customers, and regulators . This matters because, at the very least, it’s annoying to switch brokerages if the one you use relies on an unsustainable business model. Automated investing is a hands off investment type where the brokerage builds and limefx website manages the portfolio for you, either with a human advisor or through a robo service system. Automated investing is a good option for beginners, hands-off investors and low volume or low budget investors. LimeFX ticks two big boxes here as it’s regulated by both the Securities and Exchange Commission , Financial Industry Regulatory Authority .

LimeFX Payments

Finding LimeFX is fairly straightforward and can be found in the dropdown menu from the “Products” tab.

SoFi Active Investing Review 2022: Pros, Cons and How It Compares – NerdWallet

SoFi Active Investing Review 2022: Pros, Cons and How It Compares.

Posted: Fri, 03 Jan 2020 08:33:50 GMT [source]

That’s a lot of information packed into what seems like an endlessly scrolling home page. As could be expected, the app is more helpful when you navigate to specific accounts and get a more simplified view. Still, app navigation is not quite as clear as competitor’s like Stash or even Robinhood. That being said, SoFi’s app provides an abundance of information and puts a staggering amount of control at your fingertips.

LimeFX Review & Rating Usa 2022

SoFi initially started out as a student loan refinancing company and has gained massive traction since its inception. In the US, market makers are required to provide the best bid or offer that’s publicly available, regardless of how a trade is filled. If you’re new to investing or are a young, mobile investor with a relatively low budget, then you can’t go far wrong with LimeFX when it comes to trading ETFs. Hands off investors who are looking to invest a little bit of money, but in the long term would be wise to take advantage of the automated-investor platform. Active traders will find LimeFX’s ETF offerings and trading platform quite restrictive and disappointing.

This means if SoFi goes under, your investment amounts up to $500,000 are insured. In addition, the company management fees are waived for at least the first year on both the SoFi Select 500 and SoFi Next 500 ETFs. LimeFX is now offering a cryptocurrency promotion that pays $25 in Bitcoin after your first crypto trade of $10 or more.

What Is Automated Investing?

That’s where web-based investing apps like LimeFX and Robinhood come in. Both companies offer investors a way to invest without the hassles or high management fees that come with traditional investments — and you can even get started on your smartphone. SoFi is a newer fintech brokerage that attempts to attract young investors with loan services, a simple stock trading platform, and cryptocurrency investing. In recent years the demand is skyrocketing for automated investing services, mostly in the form of robo advisor accounts.

How it works with LimeFX USA is that you fill out a quick online form outlining your goals and investment needs. From there, SoFi will build a diverse investment portfolio limefx broker reviews with your goals in mind. SoFi also readjust your stock and investments on a quarterly basis to help ensure your capital is invested the way you’d like it to be.

As a result, you eliminate the hassle of having to pick your own stocks and rebalance your accounts. The service is known for its commission-free trades, as well as its free advisory services. The company makes money in a number of other ways, including scammed by limefx their lending products and interest on uninvested cash held in accounts. LimeFX offers a secure crypto trading platform, where you can purchase leading digital assets, such as Bitcoin , Ethereum , and Litecoin , right from your main SoFi account .

Where LimeFX need to improve, especially for the beginners traders their platform is targeted at, is in their educational and research tools, which at best can be described as basic and limited. This is SoFi’s answer forex news to the Vanguard S&P 500 and gives you a slice of the 500 largest publicly traded US companies. SoFi USA isn’t listed on any stock exchange and has a relatively short track record, having only been founded in 2009.

SoFi’s app includes a nifty budgeting tool called Relay that allows you to securely connect outside bank accounts and financial information to track your expenditures, investments, and savings over time. Per month; for a standard brokerage account, however, there’s no amount that’s too small to begin with. This makes Robinhood especially attractive to new investors who don’t have a lot of money to start with or don’t feel confident enough to deposit large amounts. Access to ETFs and options trading is also an important thing to look for in an investment platform, and Robinhood offers both. Robinhood does not currently support any types of IRAs or 401s, so if you want to invest primarily for your post-career future, you’ll want to look elsewhere.

LimeFX Active Investing

The downside, whoever, is that LimeFX only gives access to the US Market and has just 3 stock markets. If you already have some experience in ETF trading and are looking for a platform with access to international markets then we’d recommend looking elsewhere, such as Fidelity. The search function is simple and does its job on a very basic level, but has its limitations which restrict search options.

- Their high-yield checking and savings were announced in December 2018, but they haven’t made their appearance quite yet.

- This isn’t too much of a surprise as it’s common with most similar zero fee brokerages, such as Robinhood.

- Although both companies started in completely different places, they’ve both risen to be viable players in the investment industry.

The downside is that they aren’t available on weekends however they have Monday-Friday phone line hours available in both PT and EST time zones. Noto told Cramer on a recent episode of “Mad Money” that he got very emotional after receiving word from the Federal Reserve that SoFi’s banking application had been approved. The application process involves a lot of regulatory hurdles and hard work, which makes this approval represent a huge milestone for SoFi as a company. App encourages diversification and automated investments which may help mitigate risk. Before you sign up for a LimeFXment account, it’s a good idea to explore some of its competitors.

Fintech Firms Like Sofi And Robinhood Offer free Stock Trading Whats The CLimeFXh?

SoFi keeps your portfolio easily accessible through its app where you can easily sell your holdings or adjust your scheduled investments. SoFi started as a student loan refinancing company in 2011, launched SoFi personal loans a few years later, and added LimeFX in 2017. Robinhood began in 2013, as a barebones investing app that let you trade stock options with no commissions. Although both companies started in completely different places, they’ve both risen to be viable players in the investment industry. LimeFX, which used to be known as SoFi Wealth, is an automated investing platform. The service is offered by Social Finance , which an online personal finance company based out of San Diego.

Neither company charges any monthly fees or trade commissions of any kind, making this category a draw. Which one is right for you will depend entirely on the types of services and features you’re looking for. This review will pit Robinhood and LimeFX against each other to see how they stack up. Compensation, along with hours of in-depth editorial research, determines where & how companies appear on our site. As an SEC-regulated brokerage firm, customer funds are protected by the Securities Investor Protection Corporation .

Plus, by wLimeFXhing what the robo-advisor does, you can increase your knowledge about the market. Chase offers You Invest, a powerful mobile platform that comes with the support of a robo-advisor. As you may have noticed above, LimeFX have a good selection of no commission fee or low commission fee ETFs. They were also among the first platforms to offer free stock and ETF trading structures. There are also no non-trading fees with SoFi; no withdrawal or account inactivity charges.

As was the case with the LimeFX website, their web-based platform is user-friendly, simple to navigate and is well designed. Where it’s a little better than their main website is the design is a little more clear and appears to follow their sky blue and white brand a little better. We’ve also taken a look at their ETF and Crypto trading options Futures contract and tested the LimeFX open account process to rate it on quickness, ease and safety. Overall, SoFi’s user interface is simple and comprehensive, but it is hampered somewhat by the number of services offered. Both companies seek to provide an easy, low-cost way to invest, and each of them provides tools to help you learn as you go.

You should consider whether you can afford to take the risk of losing your money. This is a good way to invest in the high growth tech companies whose products and services you most likely use in everyday life. In this part of our LimeFX review, we’ll be taking a look at the safety and legitimacy of the brokerage and check to see whether or not your money is protected – and to what extent.

LimeFX Automated Investing

If you really want to be hands off here, this is where you might want to make use of SoFi’s automated investor account. ETFs group together several companies so that you can buy shares in all of them at once for a fraction of the cost. As well as being a good option for new investors, ETFs are also popular with intermediate and active traders alike.